Unlock Financial Freedom with Our Annuities Solutions

Welcome to Ironclad Wealth Partners, where we believe in empowering your financial future. Annuities are more than just a financial product; they're a pathway to stability, growth, and the retirement you've always dreamed of. Explore the benefits of Annuities below and take the first step towards a secure tomorrow.

Why Annuities?

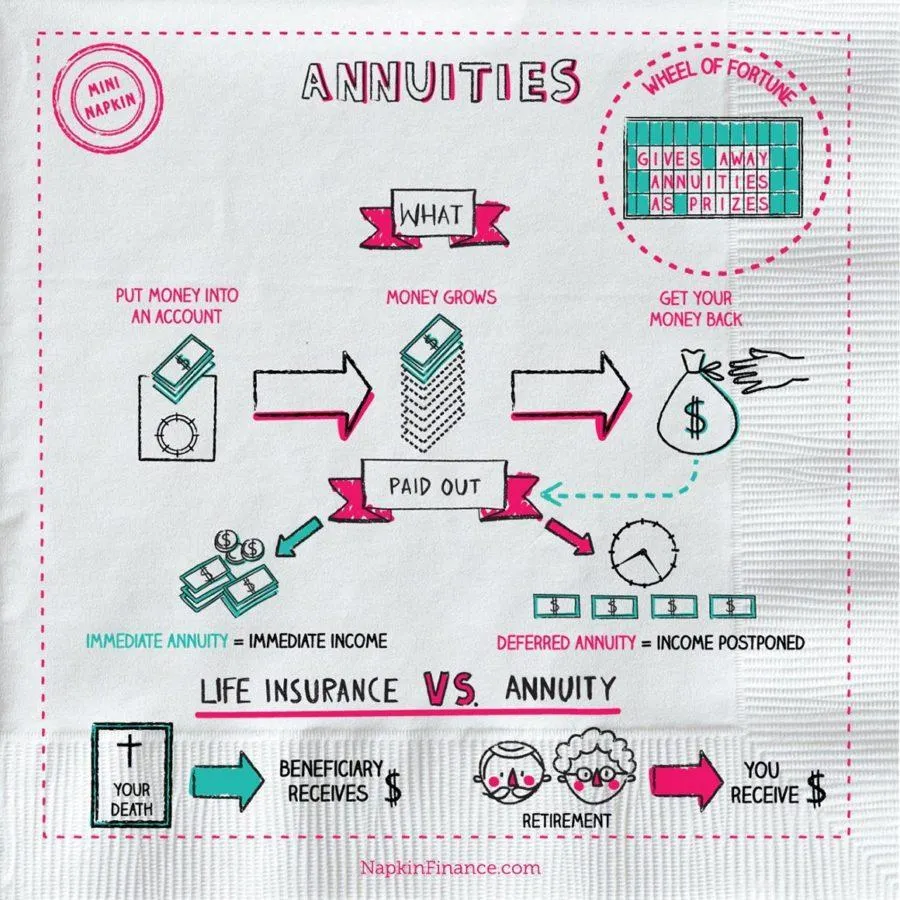

An annuity is a financial product that allows you to deposit money with an insurance company. The insurance company will then provide a series of payments back to you at regular intervals. You can use the annuity to supplement your retirement income from Social Security, pension benefits, investments, and other sources. You can convert your annuity into a stream of income that can then be paid over a fixed period or for your lifetime. You can take withdrawals of varying amounts when you need the income.

Indexed Annuities:

Combine growth potential with downside protection using indexed annuities. Link your returns to market indices, allowing you to participate in market gains while having a safety net against losses.

Wealth Accumulation:

Benefit from the potential for wealth accumulation through interest or market-linked returns, providing an opportunity for your money to grow over time.

Transform Tomorrow: Invest in Your Dreams with an Annuity – Your Passport to Financial Freedom!

Maximizing Retirement Income: Annuities as a Key Component of a Holistic Retirement Plan

Uncover the role annuities can play in optimizing your retirement income, providing stability and predictability in an ever-changing financial landscape.

How does taking money from my annuity or life insurance affect my Social Security?

Money taken from an annuity is considered earnings and is taxable as ordinary income and must be considered in determining the taxation of your Social Security benefits. Money received from an annuity that is a return on premiums paid, is received income tax-free and should not affect the taxation of Social Security benefits. Money taken from your life insurance policy through, a loan or withdrawal, generally are received income tax-free and should not affect the taxation of your Social Security benefits.

Will my beneficiary have to pay taxes on my annuity?

Yes, beneficiaries will be taxed on the tax-deferred interest when they receive those dollars. However, if a beneficiary is the spouse of the owner and the owner dies, he/she may elect to continue the annuity and postpone taxes. If the beneficiary is not the spouse and the owner dies, then the funds must be totally withdrawn within five years or they may be received over the beneficiary’s life expectancy, as long as the beneficiary elects this option within the first 12 months following the annuity owner’s death.

What are the benefits of an annuity?

The benefits of an annuity include principal protection, the potential for guaranteed lifetime income, and the option to leave money to your beneficiaries.